In the fast-evolving landscape of finance, technology has become a powerful catalyst for change. Financial technology, or fintech, has emerged as a dynamic force reshaping the way we manage, invest, and transact money. Mobile technology's surge presents a golden era for banking app developers, capitalizing on the growing demand for transactional ease.

From remote insurance and loan applications to online stock market investments, tax management, and currency exchange, FinTech has ushered in a new era of financial management. This article provides a comprehensive guide onhow to create a fintech app, emphasizing strategic planning and payment product development expertise.

What Is Fintech?

FinTech stands for "financial technologies." These are new financial goods that are usually sold online. In order to compete with traditional banks, the FinTech businessuses new technologies.

This includes financing, insurance, money management programs, financial planning apps, online payments and transfers, and a lot more. Financial technologies make it easier to handle financial data and give customers more security by adding extra layers of fraud protection.

Main Fintech Trends

We looked at the Fintech market and came up with five main trends. Venture funding in the late stages grew year-over-year for the first time. The number of deals rose 30% to 44, and the value of the funding rose 31% to $2.56 billion.

Fintech Strives For Banking Mobility

Banks are moving from significant buildings and faraway places to offer services closer to customers, or more specifically, to their phones. The pandemic has made the rise of online banking even faster.

Use Of Artificial Intelligence

Automatic financial data analytics are making AI the main reason for the growth of the FinTech industry and the ability of FinTech apps to change users' needs.

Fintech Development Of Crypto And Blockchain

The market is always looking into how to regulate and run crypto and blockchain environments more efficiently.

Democratization Of The Market

More information about the market is being shared, which means that businesses, individual buyers, and regular users have more chances to make money. Everyone can use a variety of markets, money management tools, and new ways to finance businesses, some of which use digital assets.

Products For The Self-Employed

The FinTech sector is driven by self-employed people and freelancers who can work from home more and more. These people need fintech apps to keep track of their taxes, make bills and receipts, and keep track of their money.

Step-By-Step Guide To Build Your Fintech App

Do Your Research

Tech people who work in fintech need to do a lot of study before they can start making an app. It would help if you made a map to lay out a plan for how the interface will look and what features it will have. Also, what the MVP creation services cover and what features they have should be obvious.

Form A Team

As I said before, you need a group of professionals to start making a Fintech app for your phone. You can either hire a third-party service or put together your team. Just make sure that everyone on the team understands why and how they are supposed to make a fintech app and that they know how the Fintech app development company works in general.

Define Mvp (Minimum Viable Product) Scope

It would help if you decided what your MVP (Minimum Viable Product) and app as a whole would do. It should be easy to understand all of the features. Make sure that your basic idea is good and that you can get the things you need to make it happen.

Select Your Technology Stack

What does the tech stack look like? I'll tell you. Building and designing apps can be done in a number of different languages. You can choose the most basic ones, like Objective C or Swift for iOS or Java and Kotlin for Android.

But, as I already said, it will cost you more if you have two apps made at the same time. There is also another way to do things. It's known as the Progressive Web App (PWA).

Apis For Basic Functionalities

Your financial app needs to be able to do a lot of different things, like tracking bills, making budgets, and so on. If you already run a business that provides these simple services, you can use these features. You have to build them from scratch for a startup.

No matter what you do, it would help if you built APIs so that everyone on the website can easily view everything. What do I suggest? Make APIs that use REST (Representational State Transfer).

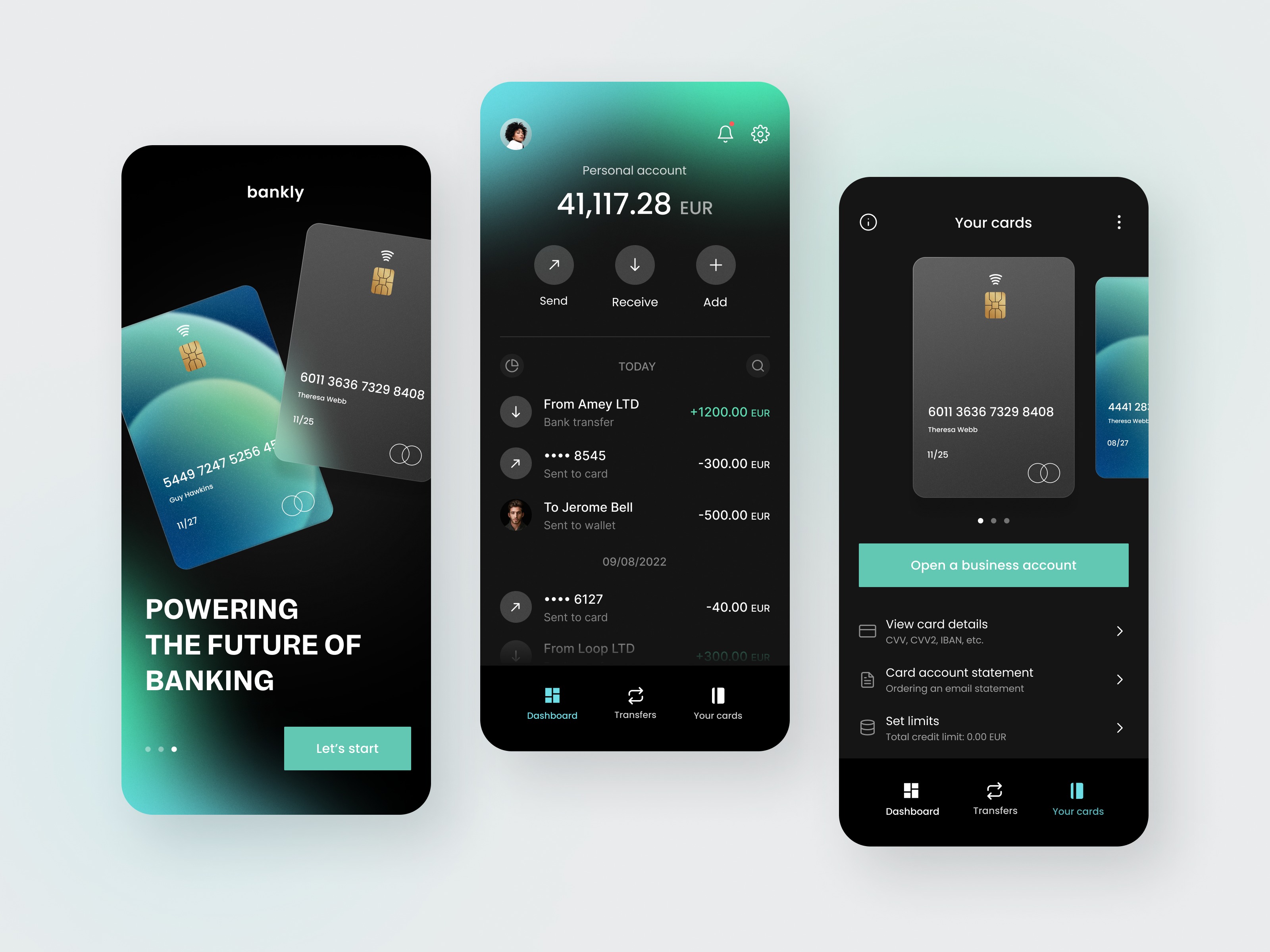

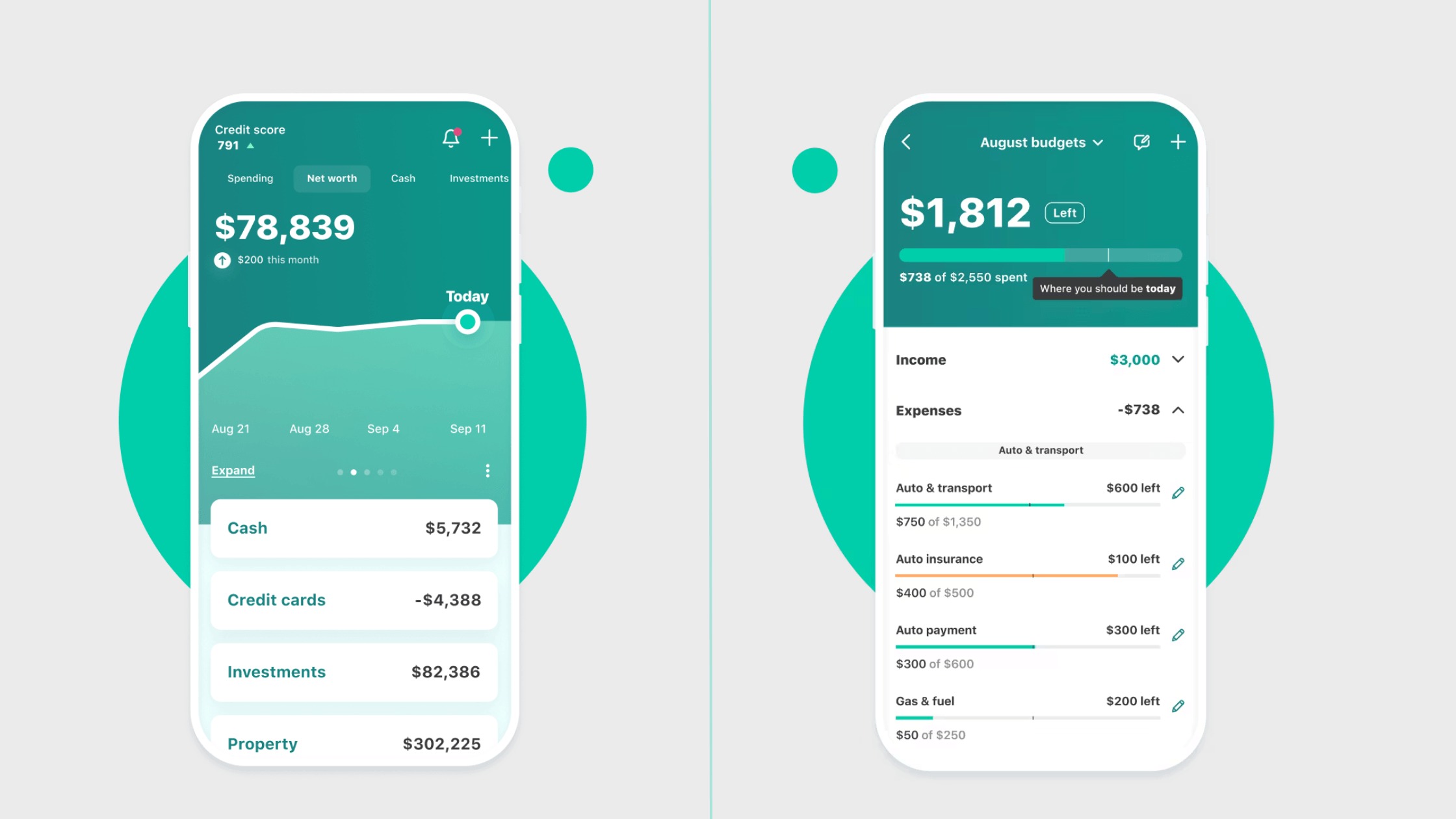

Design UI/UX

Now is the time to bring out your inner artist! Pick bright colors for your app. Make the tools more straightforward to use. Don't add functions to your interface that aren't needed. But remember that all the essential features should be easy to find on the screen, so the user doesn't have to waste time looking for them.

Test Launch

It's essential to test your app first before putting it on the market. You can limit access so that only people in your area or at work can see it. Much of what you did wrong will be fixed by the comments. When is it? Once all the issues and problems have been fixed, your app is ready to be launched.

Update Your Application

Cool new things are always going on in the IT world. Because there are so many new features, you need to keep the app up to date. Are you done with the step-by-step guide? Take a moment to learn more about Payment Solution apps, especially Fintech app creation.

Monetizing Your Fintech App

If you want to make a financial app, the first thing you need to do is decide how you will make money from it. Once your app is up and going, you can add more features and service options based on different ways to make money, but you need to start with something to start getting your money back.

In general, the main difference between monetization methods is who will pay you in the end. You can get paid by service users, third-party services or sellers, or a third party for all or some of the deals that start with your app. Here are a few examples of the most common ways that well-known fintech companies make money these days.

Subscriptions

Anyone who has ever used an online service or a mobile app of any kind knows this model inside and out. Users usually get a trial time of a few days to a few weeks to check out the features and decide if it fits their needs. When that subscription ends, users are paid the chosen subscription fee on a regular basis.

Transactional Fees

Apps that handle mobile payments and payment systems mostly use this model. Fees can be charged for any payment or just certain types. Services like Payoneer and WorldRemit are good examples of cash exchange services that offer low rates on international money transfers and a variety of ways to receive sent funds. You can use this way of making money along with payments or as your primary way of making money.

Ads And Referrals

Once you have a big enough customer base, you can make most of your money from highly targeted ads and referrals from related advertisers. Folks can use your services for free, but they will see ads that are very specifically tailored to them. For every transfer, the service owner gets paid.

For example, Mint uses this model for their free service and combines it with other ways to make money for their paid services, like keeping an eye on the user's credit score all the time.

Selling Big Data

Fintech apps are an excellent way for users to get useful financial information about their spending habits, how often they pay their bills, how much they spend on average, what services they use, and much more.

It is common for fintech companies to charge third parties to access this data. This is done so that those interested can better focus their marketing or sales efforts and get high-quality data sets for their AI and machine learning algorithms.

Paid Access To Apis

A lot of fintech companies, especially those that run payment gateways and other related services, make it easy for other companies to use their services by giving them APIs that they can call from within their software code.

Take the company, Stripe. Their API lets millions of businesses get and send money in any country, all over the world, without having to spend money building their payment systems.

Reasons To Develop A Fintech App

Now is the best time ever to make a financial app. Before we talk about how to make a fintech app, let's go over these three strong reasons why you should think about making mobile apps for fintech. To put it another way, the Americas has 11,651 fintech startups, more than any other area in the world.

Financial Illiteracy Is On The Rise

People should know more about how to handle their money now that the student loan problem is getting worse and the US and other governments are at odds over the economy. Why are people becoming less trusting of human resource and finance managers?

People want to take charge of their earnings, even if they don't know everything there is to know about it. They want to learn quickly as well. It would be great if someone could make a clever fintech app that helps regular people manage their money without having to know all the financial terms. There is a lot of desire.

Mobile Phone Penetration

The world has 5.13 billion unique cell phone users right now. That is the same as 66.6% of the world's population. Ericsson says that around 5.5 billion smartphones are in use around the world. On a smartphone, apps are everything, and most of them need to be connected to the internet, so it's safe to think that a lot of these smartphone users can connect to the internet.

Open Banking

People have had to go to the bank in order to use banking services since the beginning of time. But now that banks are going digital, they can serve more people. This new way of doing things is based on open banking. These days, banks know how important it is to be linked.

This keeps them relevant to their customers in this digital age by giving them rewards for their info. They've spent millions of dollars making APIs that let other companies make and offer banking services that add value, such as checking your credit score on your phone, handling loans, managing your capital in real time, managing your treasury, and a lot more.

Main Types Of Fintech Products

There are many chances for new financial products to be made in the FinTech business. From digital wallets to neobanking platforms, there are many ways to meet the needs of your target audience and solve different needs.

Digital Wallet

A digital wallet is a virtual wallet where people can store, move, and trade their digital assets safely. These can be digital currencies, payment cards, bank account information, and reward cards. You can use it like a genuine wallet, but online. It makes it easy to pay bills, send money to other people, and use different financial services from your phone or computer.

Nedbank

A neobank is a type of bank that only does business online and doesn't have any real locations. Neobanks, which are also called digital banks or challenger banks, provide a variety of financial services, such as banking, payments, and money management, through apps and websites that users access on their phones.

Money Transfer Software

money transfer software is a type of technology that makes sending money between people or businesses safer and more efficient. People no longer have to use cash or paper checks to send and receive money; they can use electronic ways instead.

Currency Exchange

It is possible to switch one currency for another at the current exchange rate with the help of software or a platform. People or companies can use it to exchange their local currency for a different currency.

Payment Acceptance

When a business or organization can accept different types of payment from customers for goods or services provided, this is called payment acceptance software. This means having suitable systems, technology, and procedures in place to receive and approve payments safely.

FAQs About Fintech Apps

How To Build An App For Fintech?

Hire experienced developers, ensure compliance with financial regulations, and integrate secure payment gateways for a robust fintech app.

How Do I Set Up A Fintech Startup?

Identify a niche, conduct thorough market research, obtain necessary licenses, build a talented team, and establish partnerships within the fintech ecosystem.

What Software Is Used In Fintech?

Fintech relies on various software types, including blockchain for security, AI for analytics, cloud computing for scalability, and API integration for seamless data exchange.

How Does A Fintech App Work?

Fintech apps facilitate financial transactions, manage investments, or provide banking services through user-friendly interfaces, leveraging technology like APIs and secure data encryption.

Conclusion

The flourishing fintech sector, valued at $310 billion, signifies the dynamic fusion of finance and technology. Key trends, from banking mobility to AI integration, define its evolution. The step-by-step guide to creating a fintech app underscores research, team assembly, and user-friendly design.

Monetization avenues, such as subscriptions and big data sales, highlight diverse revenue models. With rising financial literacy, widespread mobile use, and open banking, developing fintech apps have gained prominence.

From digital wallets to payment acceptance, the fintech landscape offers diverse product possibilities. Understanding how to create a fintech app becomes crucial in this era of financial innovation.