Understanding your bank statement is a vital skill for anyone who wants to maintain control over their finances and make informed financial decisions. Your bank statement is not just a piece of paper or an electronic record; it's a valuable tool that provides insights into your financial life.

It's like a financialreport card, offering a comprehensive overview of your account activity over a specific period. In this digital age, where transactions often occur with the swipe of a card or the click of a button, it's easy to lose track of where your money is going.

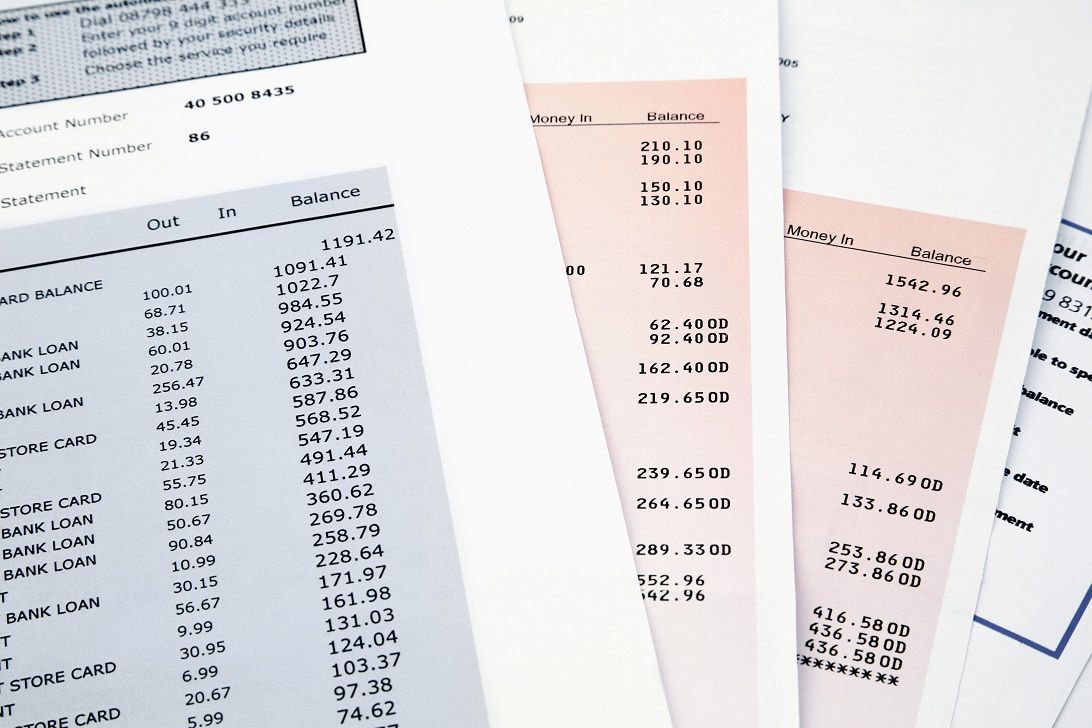

Your bank statement, whether in physical or digital form, serves as a detailed record of all your deposits, withdrawals, purchases, and fees. It tells you exactly how much money you've earned, spent, and saved during a specific time frame.

However, deciphering the numbers and jargon on your bank statement can be a daunting task if you need to become more familiar with financial terminology. That's where this article comes in. We'll break down the essential components of a bank statement and provide you with the knowledge and skills to read it like a pro.

What Is A Bank Statement?

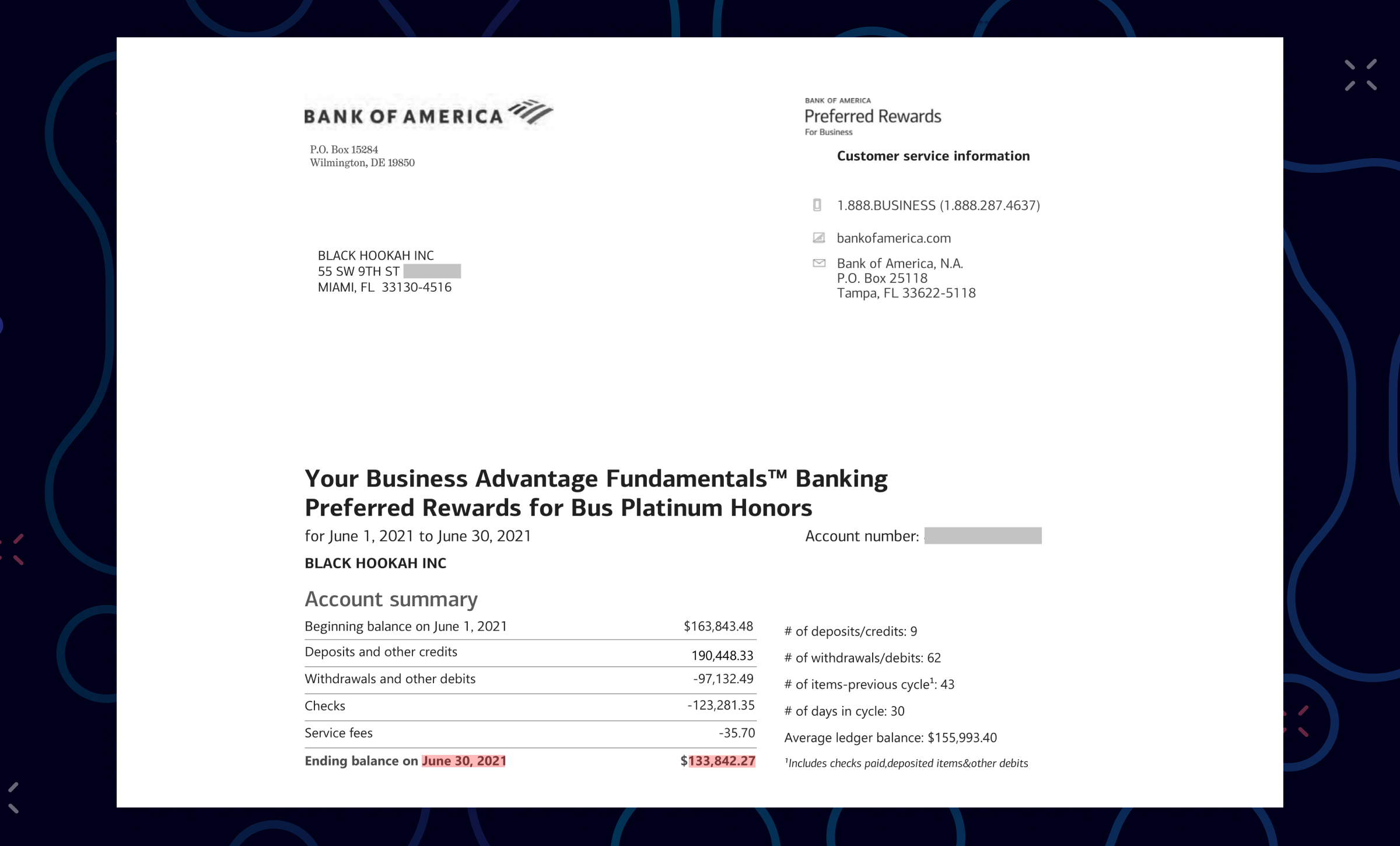

A bank statement is a written account of every transaction made to your account over a specific period, including transfers, withdrawals, and deposits. The beginning and ending balances of the account, your account number, and other crucial account details could also be shown on your bank statement.

Every deposit account you have with a bank, whether it be a certificate of deposit (CD), savings account, checking account, money market account, or anything else, should come with an account statement. Generally, your bank will give you monthly bank statements, but depending on the sort of account you have, they may also come quarterly.

Why You Should Check Your Bank Statement?

Be sure to examine your bank statement for a variety of reasons, including the ones listed below. Using it will assist you in the following;

- Take care of your financial situation.

- Reconcile your financial records.

- Find transactions that are fraudulent or that are not allowed.

- Find the mistakes that the financial institution made.

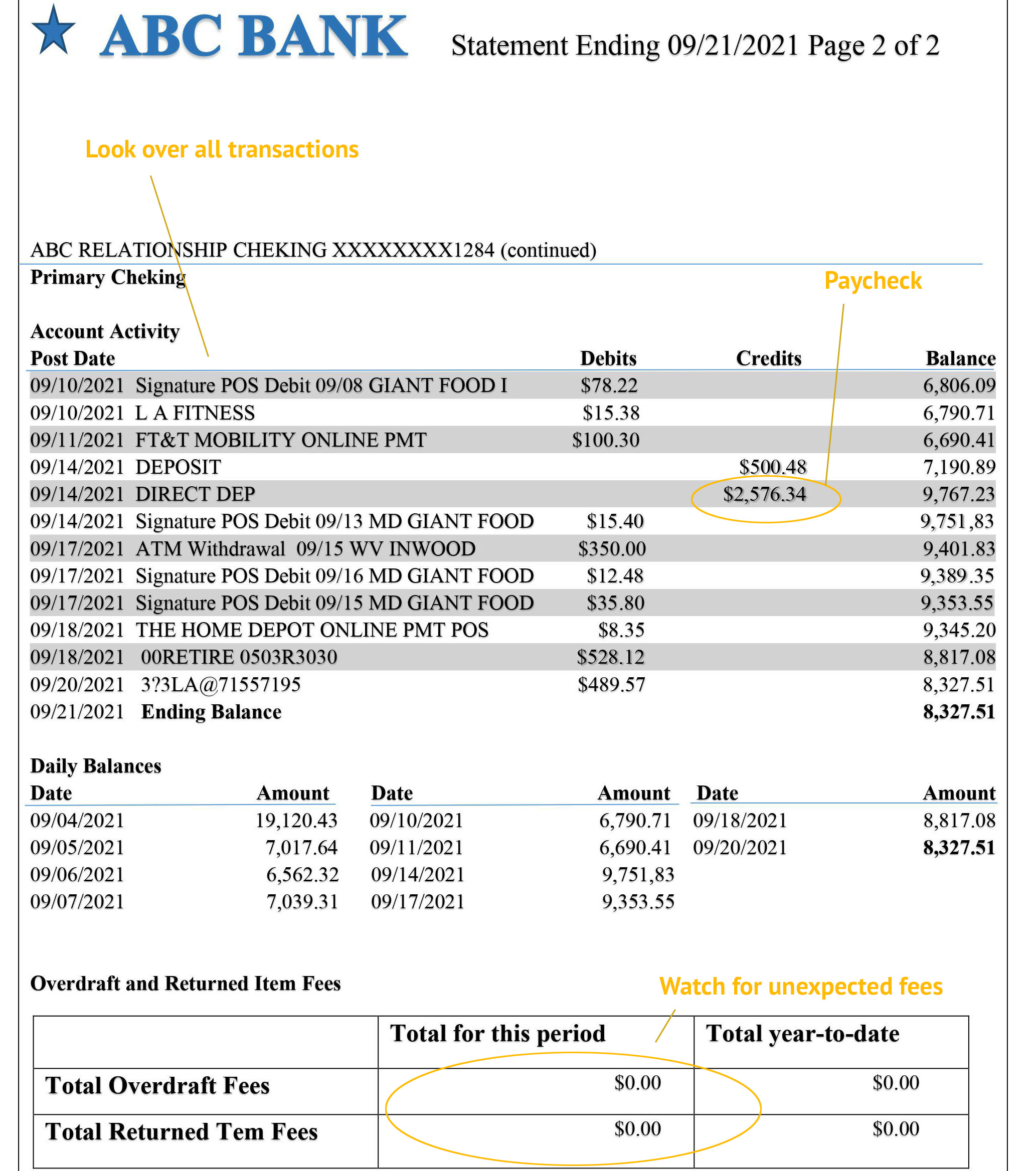

- Determine the costs that you have been charged (so that you may avoid them in the future).

- Check to see if the checks you prepared have been cashed or deposited.

- Assemble the information you need to complete your tax return. Take, for instance, the possibility of discovering philanthropic gifts that you had overlooked.

A minimum of one year should be the minimum amount of time that you should maintain your bank statements, whether they are paper or digital versions. However, you may wish to keep your statements for a period of up to seven years for tax purposes.

Types Of Bank Statements

Account holders can choose to get their statements electronically, generally by email or on paper, from many institutions.

Electronic Bank Statement

Account users can view statements online for downloading or printing when they have an electronic statement or e-statement. In order to have a permanent record, many e-statement subscribers nevertheless print their statements at home.

A few banks send consumers their statements as attachments via email. A transaction history, which is a condensed copy of a bank statement, may be printed by bank automated teller machines (ATMs).

It is usually free to get digital statements, and you can avoid monthly account maintenance costs by choosing to receive digital statements.

Paper Bank Statements

Paper statements aren't going away anytime soon, despite the importance, accessibility, and convenience of electronic statements. However, due to the expense of labor and resources for printing and mailing the statement, getting paper bank statements may result in a charge.

All told, banksoften charge a few dollars for this service every statement, which can add up if statements are received on a monthly basis. Credit unions could have lower fees. Institution-specific fees will differ. People above a specific age, like 65, or kids under a certain age may not have to pay the paper statement charge.

How To Interpret Your Bank Statement?

Your bank statement may have a different format based on your financial institution, but generally speaking, it contains the same kinds of data. Take a deeper look at what your bank statement probably contains and what it signifies.

Personal Information

Your name, address, and phone number are among the personal details seen on your bank statement. Make it essential to check this information every time you check your statement to make sure everything seems accurate.

You must update your information with your bank if you just relocated, changed your name, phone number, or both. If the details are off, it's conceivable that fraud has occurred on your account or that your bank gave you the erroneous statement by mistake.

Account Information

Important details about your account, including your account number and the name of the financial institution, are included in your bank statement. It is a good idea to review this information when you receive your statement to ensure that everything is proper. You should get in touch with the bank right away if you get a bank statement that is sent to you for an account that you do not possess. This might also be an indication of fraud.

Statement Period

Your bank statement will include a date range for the statement period since it includes all of your financial activities over a certain period. Your statement may be dated April 1 through April 30 if, for instance, your statement period begins on the first of the month and lasts for 30 days.

The precise dates of the statement period will be prominently shown on bank statements, which might aid in maintaining statement organization. Date range differences between accounts are acceptable because statement periods might fluctuate depending on the bank and kind of account.

Starting And Ending Balance

The beginning and ending balances of your account will be shown on your bank statement. You may use this to view the amount of money that you have coming in and going out throughout the statement period.

You may use the data to help develop or improve your budget by tracking expenditure trends over time. Additionally, you may view your average daily balance in that account at some financial institutions.

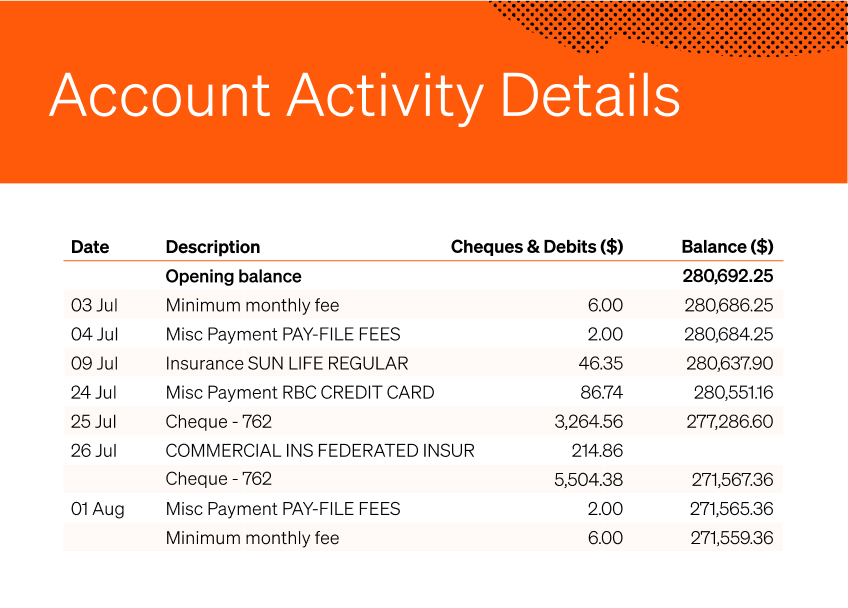

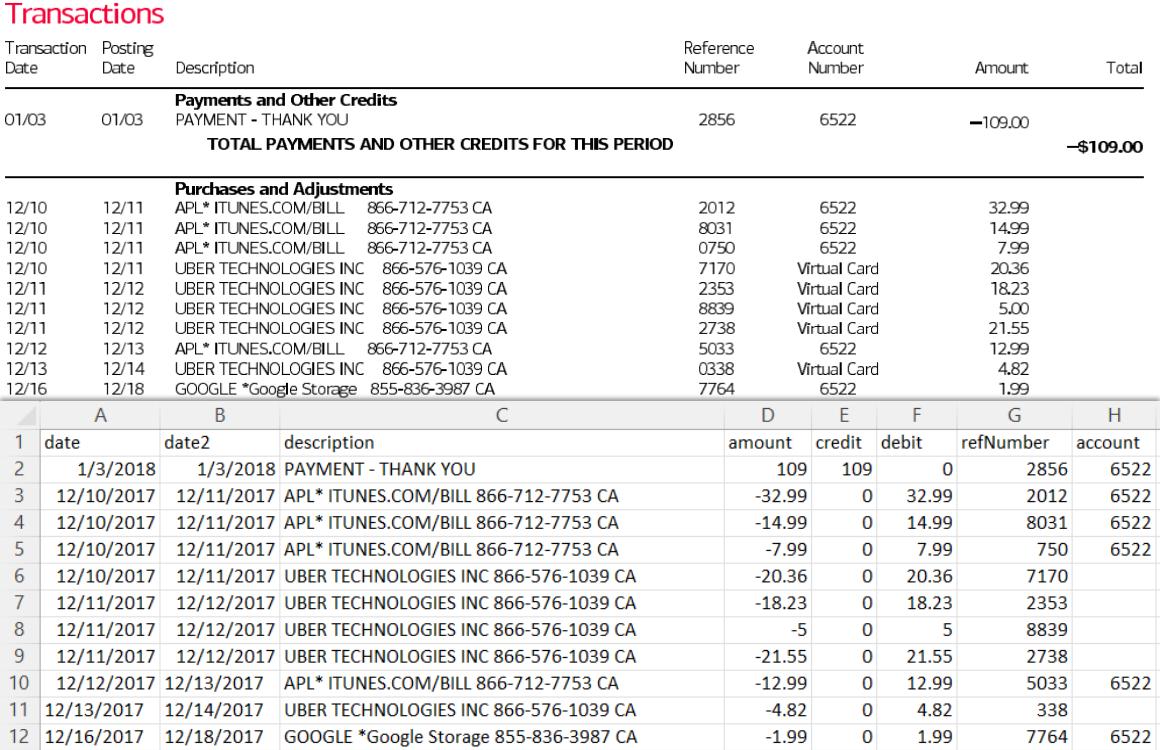

Account Utilization

You'll probably have a lot of transactions on your account within the period of your statement. Your bank statement lists this account activity over the duration of the statement in chronological order. Deposits, cash withdrawals, debits, fees, and, if you have an interest-bearing account, any interest received may also be included in the list of items.

Make sure that every transaction you look at closely matches the money that should have been entering into and going out of your account throughout the statement period.

Another helpful technique to search for charges you might have forgotten about, including autopay subscriptions and memberships, is to check the activity on your account. Additionally, make sure to notify your bank of any unusual activity you come across.

How Do You Get A Bank Statement Online?

Are you ready to see your bank statements online and print them out? Regardless of whose bank you are affiliated with, the procedure is simple and uncomplicated. To give you an idea of how the procedure works for the majority of banks;

- To access your online account with your bank, log in.

- Examine the menu on the left side of the screen for the "Statements" option.

- You can see, print, and save your bank statements in PDF format by going to the "Your Accounts" section.

- Make sure to choose the particular bank account for which you want the statement.

- You can select the period that you want for your statement.

- To view your whole bank statement, select the "View Statement" option from the menu.

- To obtain the statement, use the link that says "Download Statement (PDF)" located at the very top of the page.

- Launch the PDF file that you downloaded.

- Last but not least, you have the option of printing the PDF and retaining a hard copy of your statement.

When fresh statements are made accessible online, you will be notified via email of their availability. You will need to log in to your account, navigate to the "Statements" or "E-Statements" page, choose the account you want to see or download, and then pick the month(s) you want to view or download.

Is it more recommended that you get a physical copy or an electronic one? There are two things that you need to bear in mind, and they are environmental sustainability and privacy. Bank statements that are accessed online are often more secure, and you may also be more environmentally conscious.

The findings of a study indicate that 55% (Source: Yahoo Finance) percent of individuals opt to get both paper and electronic bills for their bank and debit card accounts each month.

It is also essential to keep in mind that the method of obtaining a bank statement online varies from bank to bank. If you require assistance with the processes, please get in touch with your bank and inquire about the process in order to receive an explanation.

How To Fix Errors On A Bank Statement

Errors on the bank statement are rare, but they can still occur! However, you must take the initiative and deal with problems right away.The majority of bank statements include further details concerning discrepancies that have been reported. The actions you need to take in this case are identical to those for most banks. This is what you should do;

Make Sure It’s An Error

Make sure what you've discovered is an error by pausing for a time. Collect any supporting paperwork or proof of the error if you can. It will be helpful in your bank correspondence.

Speak With The Bank

Make contact with your financial institution and present the proof you have acquired along with a report about the issue. The bank's contact details are available on prior monthly statements or on the financial institution's website.

The customer care department of the financial institution can be contacted via email, secure messaging, or phone by account holders. Tell them you have proof of the error when you phone, and ask how to convey it most effectively.

Contact The Third Party

Notifying the other party about the problem is also a good idea. In this manner, they may take the required steps to assist in resolving the problem more quickly.

Modify Your Documentation

Update your data in accordance with the correction of the error. In case there are any more problems, it's a good idea to preserve a copy of every correspondence you have with the bank or other parties.

Jot down the names of the people you communicate with, as well as the time and date of your discussions.

Can Anyone Check Your Bank Statement?

In the realm of personal financial privacy, the question of whether anyone can check your bank statement is a pertinent one. The short answer is no. No one can access your bank statement without your permission.

Your bank statement is considered confidential information, and banks have stringent security measures in place to protect it. Access to your bank statement is typically restricted to a few fundamental entities;

- As the account holder, you have the primary right to access your bank statement. You can do this through your bank's online portal or mobile app or by requesting a physical statement.

- The FDIC's Survey of Consumer Financesreports that 71% of bank customers regularly use online banking, and 43% use mobile banking. So you can also check your account statement from your phone.

- In some cases, you may authorize other individuals or entities to access your bank statement. For instance, if you have a joint account with a spouse or businesspartner, they may have access. Similarly, financial advisors or accountants you hire may require access to help manage your finances.

- In certain situations, government agencies, such as tax authorities or law enforcement, may obtain access to your bank statement through a legal process, such as a court-issued warrant.

- If you owe money to a creditor, they may seek a court order to access your bank statement as part of the debt collection process.

It's important to note that while your bank statement is generally protected, you should also take personal precautions to safeguard your financial information, such as regularly reviewing your statements for unauthorized transactions and protecting your online banking credentials. Your bank will have security measures in place to help protect your information, but vigilance on your part is also crucial for maintaining financial security.

How To Read Your Bank Statement - FAQs

How Can You Identify Automatic Payments On Your Statement?

Automatic payments are typically recurring transactions with fixed amounts, such as monthly utility bills or subscription fees.

What Does The Beginning Balance On My Statement Mean?

The beginning balance is the amount of money in your account at the start of the statement period, including any carryover balance from the previous statement.

How Can You Protect The Confidentiality Of Your Bank Statements?

Safeguard physical statements by storing them securely, and protect online banking credentials by using strong, unique passwords and enabling two-factor authentication for added security.

Conclusion

Knowing how to read your bank statementis an essential skill for anyone looking to maintain financial control and make informed decisions. Your bank statement serves as a valuable financial tool, offering insights into your spending habits, account activity, and overall financial health.

By regularly reviewing your bank statement, you can spot errors, track your expenditures, and ensure your financial transactions align with your budget and financial goals.

Understanding the components of your bank statement empowers you to take charge of your finances confidently. So, remember, how to read your bank statement is not just a mundane task; it's a fundamental step toward financial literacy and responsible money management.